sales tax rate tucson az 85713

The estimated 2022 sales tax rate for 85713 is. South Tucson AZ Sales Tax Rate.

Report Pima County Has Highest Property Tax Rate In Arizona Azpm

Sales Tax and Use Tax Rate of Zip Code 85713 is located in Tucson City Pima County Arizona State.

. The Arizona sales tax rate is currently. Tucson AZ 85713. 2020 rates included for use while preparing your income tax deduction.

2640 S Cottonwood Ln is located in Santa Cruz Southwest Tucson. Springerville AZ Sales Tax Rate. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817.

1 State Sales tax is 560. 1 bath 991 sq. View sales history tax history home value estimates and.

The latest sales tax rate for Tucson AZ. 2 beds 3 baths 1317 sq. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and.

This rate includes any state county city and local sales taxes. Rates include state county and city taxes. What is the sales tax rate for the 85713 ZIP Code.

Lowest sales tax 56 Highest sales tax 111 Arizona Sales Tax. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Tucson AZ. Average Sales Tax With Local.

3667 S 8th Ave Tucson AZ 85713 216000 MLS 22214199 Great opportunity for income properties with 3 separate units. 2020 rates included for use while preparing your income tax deduction. This includes the rates on the state county city and special levels.

The average cumulative sales tax rate in Tucson Arizona is 801. Shop around and act fast on a. 2022 List of Arizona Local Sales Tax Rates.

The estimated 2022 sales tax rate for zip code 85713 is 870. Spring Valley AZ Sales Tax Rate. Find the best deals on the market in Tucson Az 85713 and buy a property up to 50 percent below market value.

The 2018 United States Supreme Court decision in South Dakota v. Tucson is located within Pima County. Arizona Department of Revenue -.

1 Studio and two. The following are the tax rate changes effective February 1 2018 and expiring January 31 2028 Use the State of Arizona Department of Revenues Transaction Privilege. The current total local sales tax rate in Tucson AZ is 8700.

Zip code 85713 is located in Tucson Arizona and has a. Tucson Az 85713 tax liens available in AZ. 2640 S Cottonwood Ln Tucson AZ 85713 is a studio 1 sqft mobilemanufactured built in 1972.

The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation. Groceries and prescription drugs are exempt from the Arizona sales tax. This is the total of state county and city sales tax rates.

Arizona has state sales. This includes the rates on the state county city and special levels. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax.

The minimum combined 2022 sales tax rate for Tucson Arizona is. The latest sales tax rates for cities starting with A in Arizona AZ state. Estimated Combined Tax Rate.

There is no applicable special tax. Search for Product Service or Business Name. The minimum combined 2022 sales tax rate for Tucson Arizona is.

House located at 2719 E 22nd St Tucson AZ 85713 sold for 168500 on May 19 2022. Stanfield AZ Sales. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a.

The sales tax jurisdiction.

Industrial Space For Rent Or Lease Tucson Commercial Real Estate Group Of Tucson

List Of 6 Arizona Tax Credits Christian Family Care

5371 W Flying St W Tucson Az 85713 Realtor Com

Tucson Arizona Sales Tax Increase For Public Safety And Road Improvements Amendment Proposition 101 May 2017 Ballotpedia

Want To Retire In Arizona Here S What You Need To Know Vision Retirement

Overview Of Arizona State Back Taxes Resolution Options

Rate And Code Updates Arizona Department Of Revenue

Arizona Voters Broadly Oppose Sales Tax On Digital Services Nfib

What S The Arizona Tax Rate Credit Karma

1 How Much Sales Tax Does Trina S Trinkets Owe Each State In 2019 In Your Answer List All States In Which Trina S Operates But If Trina S Does Course Hero

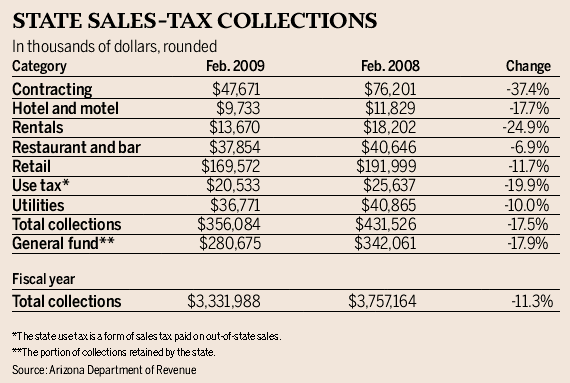

Arizona Sales Tax Collections Fell A Sharp 17 5 In February Business News Tucson Com

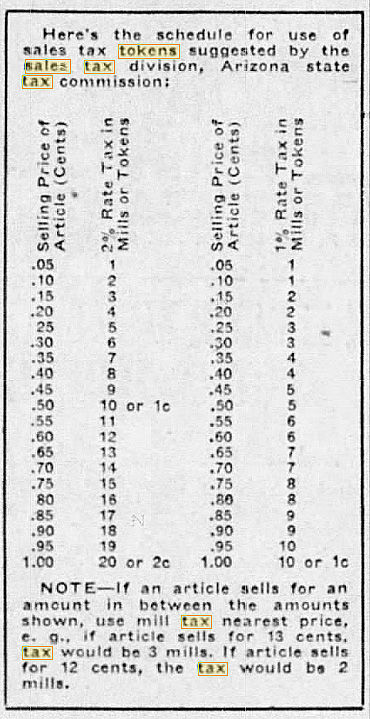

Sales Tax Chart 1937 Tucson Com

Arizona Collected Extra 52m In Online Sales Tax In First 2 Months Of New Law Local News Tucson Com

Report Unfair Arizona Tax System Unduly Burdens Poor Residents Cronkite News

1602 W Ajo Way Tucson Az 85713 Mls 22222562 Zillow

Location Based Reporting Arizona Department Of Revenue

Valley Cities Affordability And Homeowner S Comparisons City Of Mesa